We are frequently asked how to find a job in Mexico. The simple answer is that it’s difficult for a foreigner to find employment in Mexico unless they are relocated by their company or have special qualifications that would favor them over a Mexican citizen. Special qualifications include jobs that require specific managerial, technical or language skills. For example, a resort in Cancun may offer employment to a foreigner who is bilingual and has international training in hospitality management.

In truth, the best way to find a job in Mexico is to do what many Mexicans do, which is to start your own business. The majority of Mexicans are self-employed in some enterprise, either formally or informally.

Many foreigners have moved to Mexico and started successful businesses. Some are multinational corporations, such as Wal-Mart or General Motors. Foreign manufacturers have moved some of their operations to Mexican factories, called maquiladoras. Individual entrepreneurs start various kinds of businesses, such as opening a small hotel, managing a real estate agency, operating a tour company or simply renting their vacation home. Others work for foreign employers, using the Internet to telecommute to the office.

Many foreigners have moved to Mexico and started successful businesses. Some are multinational corporations, such as Wal-Mart or General Motors. Foreign manufacturers have moved some of their operations to Mexican factories, called maquiladoras. Individual entrepreneurs start various kinds of businesses, such as opening a small hotel, managing a real estate agency, operating a tour company or simply renting their vacation home. Others work for foreign employers, using the Internet to telecommute to the office.

Regardless of the business you conduct in Mexico, however, any income earned while physically in Mexico is subject to Mexican taxation, whether the income is from a foreign or domestic source. For this reason, it’s important to know the laws and requirements for operating a business legally in Mexico. Not that long ago, the laws were rarely enforced and foreigners were tempted to ignore them. Those who do so today are taking the unnecessary risk of losing their business investment.

Business Activity

There are some business activities in which foreigners are not allowed to participate. Only the Mexican Government can operate a business involved with oil exploration, extraction or distribution. This well-known government-owned company is called Petróleos de México or PEMEX. Another government-owned energy company is the Comisión Federal de Electricidad or CFE, which is Mexico’s electric company.

Some business activities require that all or some of the stock holders or members of the company be Mexican citizens. The mining and transportation industries are among these. But most business activities pursued by foreigners are not restricted. If you are unsure if your proposed business activity is restricted, contact us for clarification.

Work Visa

The first step in starting a business in Mexico is to obtain the correct visa. Resident visas with provisions that allow the visa holder to earn income in Mexico are mandatory. The requirements for obtaining one of these visas are straightforward, and if the requirements are satisfied, approval is routine. To learn how to apply for a resident visa, read our article: FM3 and FM2 Visas. For comprehensive information about immigration laws and procedures, download our Immigration Guide.

Note: If you form a company in Mexico, actions taken by a foreigner as an officer of the company without proper visa status will have no legal effect. While the process of obtaining proper visa status is pending, major acts or transactions may be conducted on behalf of the company by a special delegate appointed specifically for such purposes by a member meeting in the case of a Limited Liability Company or by a shareholders meeting in the case of a corporation.

Tax Identity

There are two types of tax identities in Mexico. A persona fisica is an individual taxpayer. A persona moral is a business entity, such as a corporation. If you work as an individual and earn income directly from clients, or if you work for a Mexican company and receive income or dividends, you are required to pay taxes as a persona fisica using your personal tax identification number. If you establish a Mexican corporation or Limited Liability Company, the business entity is required to pay income taxes as a persona moral using its tax identification number.

There are two types of tax identities in Mexico. A persona fisica is an individual taxpayer. A persona moral is a business entity, such as a corporation. If you work as an individual and earn income directly from clients, or if you work for a Mexican company and receive income or dividends, you are required to pay taxes as a persona fisica using your personal tax identification number. If you establish a Mexican corporation or Limited Liability Company, the business entity is required to pay income taxes as a persona moral using its tax identification number.

The Mexican tax authority is called Secretaría de Hacienda y Crédito Público (SHCP) or simply “Hacienda” for short. The administrative division of the SHCP for tax collection is called Servicio de Administración Tributaria or SAT. They issue a Cédula de Identificación Fiscal, which is a certificate bearing the Registro Federal de Contribuyente or RFC. The RFC is the tax ID number.

Business Structure

The business structure you choose will depend on your business activity, level of expected income, type of capital equipment, number of employees, legal liabilities and many other factors.

Independent Contractor

If you are an individual providing your services to clients and are willing to accept personal liability, then you can probably conduct business and pay taxes as a persona fisica and not establish a Mexican business entity. This kind of worker is generally referred to as an independent contractor. These jobs include lawyers, doctors, translators, photographers, massage therapists and consultants, to name a few. As an independent contractor, you can issue formal invoices called facturas to clients that require them, and these clients will withhold and pay your taxes. Income received from these clients is called honorarios. If you receive income that is not reported by your clients, you are personally liable for the withholding taxes and they must be paid by you through a Mexican tax accountant.

Note: Foreigners who want to perform certain activities, such as legal or medical services, will need to validate their credentials according to Mexican legal criteria for their specific field.

Sole-Ownership Corporation

There is technically no such thing as a “sole proprietorship” in Mexican business law. However, there is a sole-ownership form of company called Actividad Empresarial. There can be only one shareholder and the individual is liable for any and all aspects and activities of the business, and his personal assets are at risk. Neither can the corporation own real assets. But it can employ others, issue facturas and pay taxes as a business entity.

Note: Independent contractors and small businesses, such as the above, may receive a tax designation from SAT called Pequenos Contribuyente, or small contributor. If the business earns less than $1.5 million pesos per year (roughly $120,000 dollars), then it can pay a reduced flat tax with simplified tax filing. Foreigners must hold a working visa to qualify.

Limited Liability Company

A Mexican LLC is called a Sociedad de Responsabilidad Limitada (S. de R.L.) or if funded with variable capital, the title is appended with de C.V. This business entity is similar in most respects to Limited Liability Companies in other countries. The Members of a Mexican S. de R.L. are liable only for the amount of their investment and may or may not receive income, depending on their role. This business entity can issue facturas and own real property. Taxes are paid on a monthly and annual basis. These are the requirements and conditions for starting this kind of company:

- Minimum capital requirement: $3,000 MXN (~$240 USD)

- Minimum of two members

- Members make an initial investment that establishes their percentage of ownership

- One membership per investor. Votes are determined by investment. (For example, if one member invests $2,900 pesos, and the second member invests $100 pesos, Member #1 has 29 votes and Member #2 has 1 vote.)

- Decisions must be approved by a majority of member votes, representing more than 51% of the capital, unless the company bylaws require a higher majority percentage

- The company can be managed by a single manager or be board managed

- Management can be members of the LLC or a third party appointed for that purpose

- The highest authority for this company resides with the Members Meeting

Corporation

A Mexican corporation is called a Sociedad Anonima (S.A.) or if funded with variable capital, the title is appended with de C.V. This business entity is similar in most respects to corporations in other countries. Shareholders are not personally liable other than for the actions taken by them as members of the management of the company. The company can issue facturas, hold real property and pays taxes on a monthly and annual basis. The following should be considered when establishing a Mexican corporation:

- Minimum capital requirement: $50,000 MXN (~$4,000 USD)

- Minimum of two shareholders

- A shareholder’s investment establishes their percentage of ownership

- In order to establish the corporation, initial stockholders must deposit at least 20% of the total share value into a bank account in the name of the corporation. The remaining 80% must deposited into the same account according to a schedule established by the shareholders.

- The company may be managed by a single individual (Administrador Unico) or a board of directors (Consejo de Administración) (who may or may not be shareholders). Directors are appointed by a meeting of shareholders for a specified period of time and are subject to dismissal.

- The supreme authority of the company is the Shareholder’s Meeting

- Ordinary shareholder meetings are held at least annually to appoint or release directors, establish compensation and approve the company’s financial statement. Extraordinary meetings can be held as required to modify company bylaws or for any other reason.

- Decisions in ordinary shareholder meetings must be approved by at least 51% of the votes. In extraordinary meetings, decisions must be approved by at least 75% of the votes.

These business entities are established through a legal document called a Constitutiva. From a legal, accounting and business administration perspective, there are no meaningful differences between a Mexican corporation and a Limited Liability Company. The only significant differences are those related to the formation and management of the company, as indicated above.

According to the Ley de Inversion Extranjera (Foreign Investment Law), in becoming a member or shareholder of a Mexican business entity, you agree to act and be treated like a Mexican citizen in the context of property ownership and business operations. Any attempt to seek protection from your country of origin can result in forfeiture of your shares or membership in that business entity.

One of the advantages of establishing a Mexican business entity is the ability to hire employees. Foreigners need to be aware that Mexico’s laws and traditions generally favor the employee over the employer in any dispute. For this reason, it is important to learn what constitutes fair treatment of workers in Mexico and how to protect your business interests in the event of a conflict. We strongly recommend that foreigners intending to hire employees in Mexico download and study our Employment Guide.

Other Business Structures

There are several other types of business entities in Mexico that don’t often apply to foreigners starting a business here. These include non-profit organizations called Associación Civil (A.C.), which are mostly charitable groups, and professional organizations called Sociedad Civil (S.C.), which are generally comprised of accountants, lawyers, teachers, engineers and others with shared disciplines. If you have an interest in starting one of these types of business entities, please contact us for more information.

Business Opportunities in Mexico

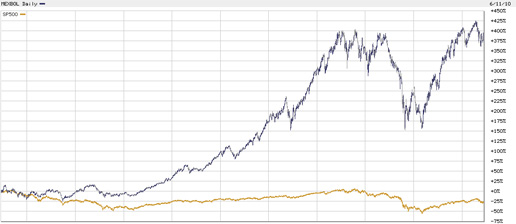

Mexico’s modernized economy is more vibrant than is generally recognized and offers a unique opportunity to foreigners thinking of starting a business. Over the past ten years, Mexico’s stock market has outperformed the S&P 500 by 400%. Economists estimate that Mexico’s Gross National Product (GDP) will grow more than twice as fast as the United States’ in the coming year. Surprisingly, job growth in Mexico exceeded that of the United States over the past two years. In the last ten years, the public and private sector have invested millions in new or improved infrastructure, including highways, airports, broadband Internet, schools, health care facilities and shopping malls.

If you are looking for a new career, see a fresh opportunity or have special skills that are needed in Mexico, it’s never been easier to start your own business “south of the border”. Yucatan Expatriate Services is here to help. We offer a full range of consulting, accounting and legal services to ensure that your business startup is done right the first time.

Disclaimer: This article represents the opinions of the writers and does not constitute legal or accounting advice. It is recommended that before taking any action, you should consult with your own accountant or lawyer who is familiar with the laws and customs in Yucatan and in Mexico, and the circumstances surrounding your particular situation.